Advertiser Disclosure: SuperOffers.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, SuperOffers.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

Online banking has become a popular and convenient way to manage your money and access financial services. With online banking, you can easily check your balance, pay bills, transfer funds, and more from your computer or smartphone. It also offers some benefits that traditional banks may not, such as lower fees, higher interest rates, and cashback rewards.

However, not all online banking options are the same. There are many different companies that provide online banking services, each with its own features, advantages, and drawbacks. How do you choose the best online banking option for your needs?

In this article, we will review five of the best online banking offers available in the market: Revolut, Chime, Varo Money, SoFi Money, and Ally Bank. We will compare their services, features, benefits, and user reviews to help you make an informed decision.

What We'll Cover

Revolut

Revolut is a digital banking platform that aims to provide a global alternative to traditional banks. Revolut offers a range of services, such as currency exchange, international transfers, budgeting tools, crypto trading, and more. Revolut also has a debit card that you can use to make purchases and withdraw cash from ATMs worldwide.

Revolut’s online banking offer is attractive for users who want to have more control over their money and access to global financial services. Revolut users can enjoy low fees, high rewards, and flexibility in managing their finances.

Chime

Chime is an online-only bank that focuses on providing simple and transparent banking services. Chime offers a checking account, a savings account, and a debit card that you can use to make purchases and withdraw cash from over 38,000 fee-free ATMs nationwide.

Chime’s online banking offer is appealing for users who want to have a simple and hassle-free banking experience. Chime users can enjoy fee-free banking, automatic savings, and early access to their money.

Varo Money

Varo Money is an online-only bank that offers a checking account, a savings account, and a debit card that you can use to make purchases and withdraw cash from over 55,000 fee-free ATMs worldwide.

Varo Money’s online banking offer is attractive for users who want to have a high-yield and low-cost banking option. Varo Money users can enjoy fee-free banking, high-interest savings, and early access to their money.

SoFi Money

SoFi Money is a cash management account that combines the features of a checking and a savings account. SoFi Money offers a debit card that you can use to make purchases and withdraw cash from over 55,000 fee-free ATMs worldwide.

SoFi Money’s online banking offer is appealing for users who want to have a versatile and rewarding cash management option. SoFi Money users can enjoy fee-free banking, high-interest savings, and cashback rewards.

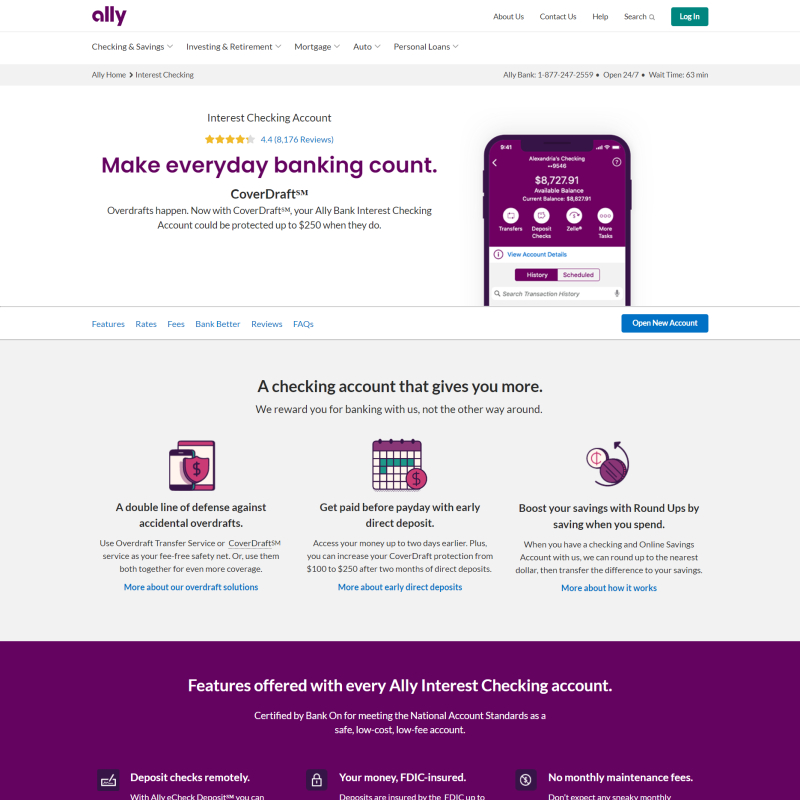

Ally Bank

Ally Bank is an online-only bank that offers a range of financial products and services, such as checking accounts, savings accounts, CDs, IRAs, loans, credit cards, and more. Ally Bank also offers a debit card that you can use to make purchases and withdraw cash from over 43,000 fee-free ATMs nationwide.

Ally Bank’s online banking offer is attractive for users who want to have a comprehensive and competitive banking option. Ally Bank users can enjoy fee-free banking, high-interest savings, and cashback rewards.

Comparison and Conclusion

As you can see, there are many online banking options available in the market, each with its own pros and cons. To help you compare them more easily, here is a table that summarizes their main characteristics:

| Characterisc | Revolut | Chime | Varo Money | SoFi Money | Ally Bank |

|---|---|---|---|---|---|

| FDIC Insurance | No | Yes | Yes | No* | Yes |

| Monthly Fee | No | No | No | No | No |

| Overdraft Fee | No* | No | No* | No | No* |

| Foreign Transaction Fee | No* | No | No | No | No |

| ATM Fee | Yes* | No | No | No | No |

| Interest Rate | Up to 0.65% | 0.50% | Up to 3% | Up to 0.25% | Up to 0.50% |

| Cashback Rewards | Up to 1% | No | No | Yes* | Yes* |

| Early Direct Deposit | No | Yes | Yes | Yes | Yes |

*Conditions may apply

Now, let's break it down a bit:

- Revolut is your go-to for currency exchange, international transfers, and crypto trading. However, keep in mind it's not a bank and doesn't offer FDIC insurance.

- Chime is all about fee-free banking and automatic savings with round-ups. But, it's pretty basic and only offers checking and savings accounts.

- Varo Money is a high-yield savings champ with up to 3% interest and overdraft protection up to $50. Just be aware of some eligibility requirements and restrictions for opening an account.

- SoFi Money offers cashback rewards on select categories and partners. However, like Revolut, it's not a bank and doesn't have FDIC insurance.

- Ally Bank is a one-stop-shop, offering a range of financial products and services, such as CDs, IRAs, loans, credit cards, and more. But, it doesn't support cash deposits at ATMs or retailers.

So, which one takes the crown? Well, that depends on what you're looking for. But if we had to pick one, we'd give the trophy to Ally Bank.

Why Ally Bank, you ask? It's simple. Ally Bank checks most of the boxes. It offers fee-free banking, high-interest savings, cashback rewards, early direct deposit, and more. Plus, it's got a variety of financial products and services to help you reach your financial goals. And let's not forget about its stellar reputation and customer service.

But remember, the best online bank for you is the one that fits your needs and lifestyle. So, do your homework, compare your options, and make the choice that feels right for you.

To find all the details about the terms and conditions of an offer, check the online credit card application. We put a lot of effort to present you accurate and up-to-date information; however, we do not guarantee the accuracy of all credit card information presented.

Editorial Disclosure: All reviews/opinions expressed here are author's alone, and have not been reviewed, approved, or otherwise endorsed by any advertiser included within our content. The information presented on this page is accurate as of the posting date; however, some of the offers mentioned below may have expired. Check the issuer's website for the most recent information.

Advertiser Disclosure: SuperOffers.com has partnered with various providers to offer a wide range of credit card products on our website. Both our website and our partners may receive commissions from card issuers. As part of an affiliate sales network, SuperOffers.com receives compensation for directing traffic to partner sites. This compensation may impact how and where links appear on this site. This site does not include all financial companies or all available financial offers.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

It's clear that online banking has a lot of advantages over traditional banking. Lower fees, higher interest rates, and convenience are major selling points.

I switched to Chime last year and I've saved so much on banking fees since then. Their app is really easy to use as well.