If you’re looking to lower your car insurance costs, you may have heard about various government programs designed to provide financial assistance or discounts on insurance premiums. While these programs can offer some help, they may not be the most effective or reliable way to reduce your expenses. For a faster, more comprehensive solution, consider using BestInsurer.com — the most advanced insurance price comparison service that can help you find the lowest rates, even if you already have insurance.

Let’s dive into the government programs available for auto and home insurance, and then explore why comparing prices on BestInsurer.com is your best bet for saving money.

What We'll Cover

- Government Programs to Help Reduce Auto Insurance Costs

- Low-Cost Automobile Insurance Programs (LCAIP)

- Good Driver Discounts

- Military Discounts

- Federal Employee Discounts

- Government Programs to Help with Home Insurance

- National Flood Insurance Program (NFIP)

- State Windstorm Insurance Programs

- Homeowner’s Assistance Program (HAP)

- The Best Way to Lower Your Insurance Costs: BestInsurer.com

- Conclusion: Maximize Your Savings with BestInsurer.com

Government Programs to Help Reduce Auto Insurance Costs

Several government programs aim to help lower the cost of auto insurance for eligible drivers. Here are a few you should know about:

Low-Cost Automobile Insurance Programs (LCAIP)

- Available in select states like California, Hawaii, and New Jersey, these programs provide affordable liability coverage to low-income drivers.

- Eligibility typically requires meeting income limits, maintaining a good driving record, and owning a vehicle with a modest market value.

Good Driver Discounts

- Some states mandate that insurers offer discounts to drivers who have maintained a clean driving record for several years.

- While this is a state requirement, the discount rate may vary between insurers.

Military Discounts

- Active duty military personnel, veterans, and their families may be eligible for special discounts on car insurance in many states.

- Discounts can range from 5% to 15%, depending on the provider and the state regulations.

Federal Employee Discounts

- Some insurance companies offer discounts to current and former federal employees. This is not a government program per se, but insurers may provide it as an acknowledgment of public service.

While these programs can help reduce your auto insurance costs, they often come with limitations such as eligibility requirements, restricted coverage options, or small discounts. Moreover, not all of these programs are available nationwide, which can make finding the right one a challenge.

Government Programs to Help with Home Insurance

For homeowners, there are also a few programs and initiatives that aim to reduce the cost of home insurance:

National Flood Insurance Program (NFIP)

- Managed by FEMA, this program provides affordable flood insurance to property owners in participating communities.

- While it helps cover flood-related damage, it doesn’t reduce overall home insurance costs and may be an added cost if your property is in a high-risk flood zone.

State Windstorm Insurance Programs

- Available in hurricane-prone states like Florida and Texas, these programs provide windstorm and hail coverage at a reduced rate to residents in high-risk areas.

- It offers coverage against specific perils but does not reduce the overall cost of standard home insurance.

Homeowner’s Assistance Program (HAP)

- Provides financial assistance to eligible homeowners who need help making mortgage payments, which can indirectly affect their ability to maintain home insurance.

- This program is only available to specific groups, such as military members or government employees relocating for work.

While these government programs might provide some level of relief, they’re often limited in scope, and eligibility requirements can be restrictive. Additionally, many of these programs are focused on specific types of coverage (like flood or wind damage) rather than overall cost reduction.

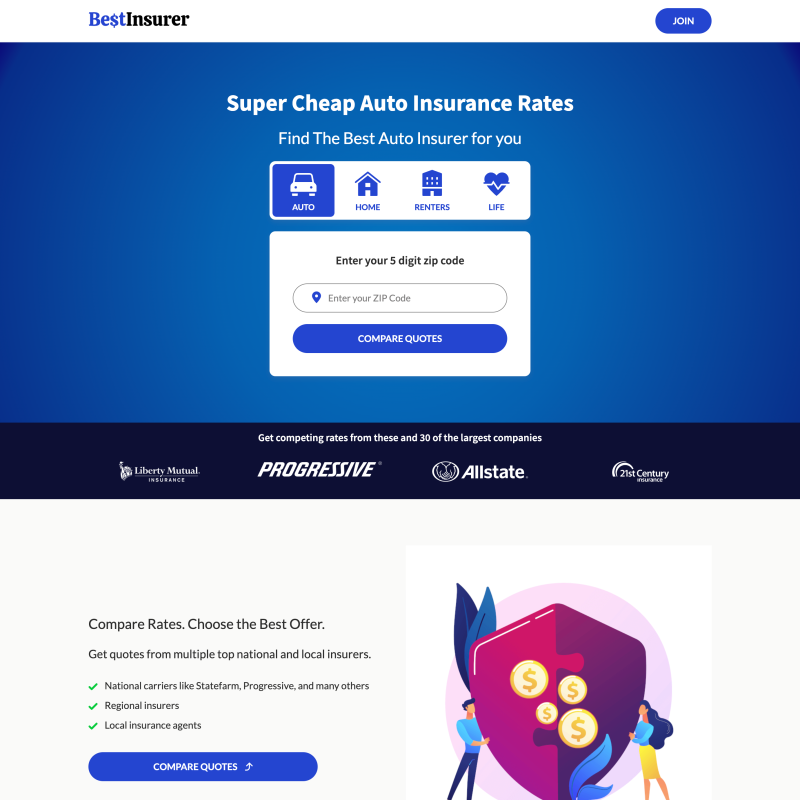

The Best Way to Lower Your Insurance Costs: BestInsurer.com

While government programs offer some discounts and aid, they’re not the most comprehensive solution for reducing your car or home insurance costs. The best way to ensure you're getting the lowest possible rate is to use BestInsurer.com, an advanced insurance price comparison service that helps you find the best deals from hundreds of providers.

Why BestInsurer.com Is the Best Way to Reduce Your Insurance Costs

While government programs offer some assistance, they're often limited and not accessible to everyone. The most effective way to lower your insurance costs is by using BestInsurer.com. Here's why:

- Comprehensive Comparison Shopping

BestInsurer.com allows you to compare prices from hundreds of insurance providers in one place. This extensive comparison ensures that you're getting the best possible rate.

- Savings Even if You Already Have Insurance

Think you're locked into your current rate? Think again. Even if you already have insurance, BestInsurer.com can help you find a lower cost option. Insurance rates frequently change, and new discounts become available all the time.

- Customized Quotes

By entering some basic information, you receive customized quotes tailored to your specific needs. This means you're not just getting the cheapest insurance—you're getting the best value for the coverage you require.

- User-Friendly Interface

BestInsurer.com's platform is designed to be user-friendly, making it easy for anyone to navigate and find the best insurance rates without any hassle.

- No Hidden Fees

There are no hidden fees or charges when you use BestInsurer.com. The service is completely transparent, ensuring you know exactly what you're paying for.

Conclusion: Maximize Your Savings with BestInsurer.com

While government programs can provide some assistance in reducing your car and home insurance costs, they are often limited by eligibility requirements, small discounts, or geographic availability. For a more comprehensive, hassle-free solution, turn to BestInsurer.com. With its powerful comparison tools, you can find the best insurance rates available and start saving money immediately. Don't settle for minimal discounts — visit BestInsurer.com today and discover how much you could be saving!

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Allstate Insurance [2024 Review]](/assets/images/c5cb2362877f284c0d4bbee9b16738a3.png)