Insurance is an essential aspect of life for many people, especially in Germany, where some types of insurance are compulsory, such as health, car, and liability insurance. However, finding the right insurance company can be challenging, given the many options available in the market. How can consumers find the best insurance company for their needs, preferences, and budget?

What We'll Cover

One way to narrow down the choices is to look at direct insurance companies, which are insurance providers that sell and manage their policies online, without the intermediation of agents or brokers. Direct insurance companies have several advantages over traditional insurance companies, such as lower costs, faster service, and more transparency. However, not all direct insurance companies are equal, and consumers need to consider various factors when choosing the best one for them.

Some of these factors include:

Coverage Options

The kinds and scope of insurance products offered by the company, such as car, home, liability, legal, health, life, and travel insurance. Consumers should look for coverage options that match their needs and expectations, as well as offer flexibility and customization.

Customer Service Excellence

The quality and availability of customer service provided by the company, such as online service capabilities, customer reviews and satisfaction, accessibility and responsiveness, and complaint resolution. Consumers should look for customer service excellence that reflects the company’s professionalism and reliability.

Pricing and Affordability

The price and value of the insurance policies offered by the company, such as competitive analysis, discounts and special offers, pricing structure, and financial benefits. Consumers should look for pricing and affordability that suit their budget and offer them the best value for their money.

Technological Advancement

The level and innovation of technological integration and digital services offered by the company, such as online contract management, claims reporting, chatbot assistance, digital customer service tools, and innovation in services. Consumers should look for technological advancement that enhances their convenience and experience with the company.

Company Reputation and Financial Stability

The reputation and financial performance of the company in the market, such as market position and share, industry awards and recognition, customer ratings and feedback, financial statements and disclosures, and regulatory compliance. Consumers should look for company reputation and financial stability that indicate the company’s trustworthiness and sustainability.

We ranked the following companies based on a weighted score reflecting their performance across five key dimensions: coverage options (25%), customer service excellence (25%), pricing and affordability (20%), technological advancement (15%), and company reputation and financial stability (15%). Taking into account current trends affecting the insurance market in Germany, such as digital transformation, customer expectations, regulatory changes and competitive dynamics.

We hope that this article will help you navigate the best 8 insurance companies in Germany and make an informed decision that suits your needs.

AdmiralDirekt

AdmiralDirekt is a direct car insurance company offering low prices, flexible cover and online service. It has over 15 years of history and is part of the Admiral Group, one of the largest car insurers in the UK. It offers various types of car insurance policies, such as liability, partial or full comprehensive and accident protection. It also offers exclusive features and add-ons, such as free replacement car, workshop service and roadside assistance.

It has a high customer satisfaction rating of 4.5 out of 5 stars on Trustpilot, based on more than 10,000 reviews. Customers praise the company for its easy and fast online process, friendly and helpful staff, and fair and transparent pricing. AdmiralDirekt also has a low claims ratio of 0.9 per 100,000 contracts in 2020, which is below the industry average of 1.3.

HUK24 AG

HUK24 AG is a direct subsidiary of HUK-COBURG, Germany's largest motor insurer. It offers comprehensive coverage options for car, home, liability, legal, health, life and travel insurance. This company operates online only and has no branches or agents. It has automated service features, such as online contract management, claims reporting, and chatbot support.

The company has positive customer reviews on several platforms, such as eKomi, Finanztest and Focus Money. Customers value the company's low prices, high quality and simple online process. HUKK24 AG also has a low claims ratio of 0.7 per 100,000 contracts in 2020, below the industry average of 1.3.

It has a transparent pricing structure that reflects the risk profile and preferences of each customer, as well as lower prices than HUK-COBURG and other traditional insurers due to lower administrative costs, while offering discounts to customers who have multiple policies or use telematics devices.

Direct Line Versicherung AG (Verti)

Direct Line Versicherung AG, also known as Verti, is a direct insurance company offering innovative auto insurance solutions. The company changed its name from Direct Line to Verti in 2017 to expand its market presence and product portfolio. It offers a range of insurance products, such as car, home, liability, legal, accident and pet insurance. It also innovates in services, such as offering a digital car key for customers who lose their keys or lock themselves out of their car.

Verti offers digital customer service tools, such as online contract management, claims notification and chatbot support. It has high customer service ratings from several sources, including TÜV Saarland, eKomi and ServiceValue. Customers praise the company for its transparency, flexibility and responsiveness.

It has competitive pricing that is based on each customer's individual needs and circumstances. It also has value-added services such as free replacement car, workshop service and roadside assistance, while offering discounts to customers who have multiple policies or use telematics devices.

Allianz Direct

Allianz Direct is a direct insurance brand launched by Allianz in 2019 to compete with other direct insurers in the market. It benefits from the extensive experience and strong global reputation of its parent company. It offers policy customization options for car, home, liability, legal and travel insurance, as well as international coverage considerations for customers traveling or living abroad.

Allianz Direct integrates digital platforms for online contract management, claims notification and chatbot support. This company adheres to the global customer service standards set by Allianz Group. Customers appreciate the company's professionalism, quality and security.

It has premium services and prices that reflect the quality and reputation of Allianz Group. It also offers loyalty and package discounts to customers who have multiple policies or renew their contracts with Allianz Direct.

DA Direkt

DA Direkt is a direct insurance company specializing in automobile and liability insurance. The company has over 40 years of history and is part of Zurich Insurance Group, one of the world's leading insurers. It offers features and flexibility in auto and liability insurance policies, such as partial or full comprehensive coverage, accident protection, legal protection and driver protection.

Provides accessibility and responsiveness for customer service by phone, email, chatbot or online portal. It has high customer satisfaction metrics from various sources, such as TÜV Rheinland, eKomi, Stiftung Warentest, Focus Money, n-tv, DISQ, ServiceValue, Deutschland Test, Handelsblatt, Finanztest, Öko-Test, etc. Customers appreciate the clarity of the policy information and the possibility to quickly process claims online.

DA Direkt's prices are below the industry average for car and liability insurance due to lower administrative costs. It also has promotional offers and customer retention efforts, such as free replacement car, workshop service, roadside assistance, new customer bonus, loyalty bonus, low mileage bonus, etc.

CosmosDirekt

CosmosDirekt is a leading direct insurer known for its life and health insurance products, but also offers auto insurance. The company's strength lies in its flexible coverage plans and its commitment to providing financial security to its customers. It has several types of life insurance, such as term, endowment and unit-linked policies, as well as health insurance, such as supplemental dental, hospital and nursing care policies.

It offers the ability to manage policies online, along with its award-winning customer service. It has a high customer satisfaction rating of 4.6 out of 5 stars on eKomi, based on more than 20,000 reviews. Customers praise the company for its competence, transparency and fairness, it also has a low complaints rate of 0.6 per 100,000 contracts in 2020, below the industry average of 1.3.

CosmosDirekt has competitive pricing that is based on each client's individual needs and circumstances. It offers discounts to customers who have multiple policies or use online services in addition to financial advantages to customers who choose to invest their premiums in funds linked to mutual funds or receive a lump sum payment at the end of their policy term.

AXA Germany

AXA Germany is one of the world's largest insurers and its German subsidiary upholds the brand's reputation for quality. Offering a wide range of insurance products, from health to property insurance. It integrates innovative digital services to enhance the customer experience. Its personalized advisory and preventive services go above and beyond to ensure customer satisfaction.

It provides online contract management, claims reporting and chatbot support, as well as mobile apps and smart devices that offer additional features and benefits. It also follows the global customer service standards set by the AXA Group, which include responsiveness, transparency and empathy.

AXA Germany has premium services and pricing that reflect the quality and reputation of the AXA Group. It offers financial strength and stability, as evidenced by its high solvency ratio and credit rating. It also has loyalty and package discounts for customers who have multiple policies or renew their contracts with the company.

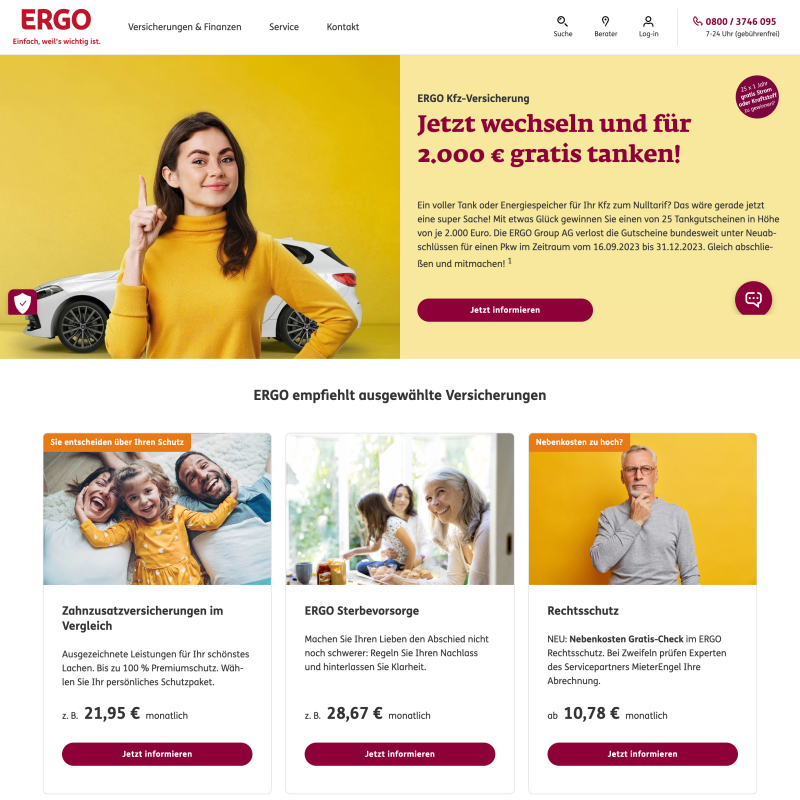

ERGO Direkt

ERGO Direkt is a direct insurance company that stands out for the ease of use of its online services and its wide range of insurance products, including health, legal and accident insurance. The company's focus on transparency and customer empowerment through educational resources on its website has earned them high customer ratings.

It offers online contract management, claims reporting and chatbot support, as well as a customer portal that allows customers to access their policies and documents anytime, anywhere. ERGO Direkt also has a high customer service rating of 4.7 out of 5 stars on eKomi, based on more than 30,000 reviews. Customers praise the company for its simplicity, clarity and speed.

It has competitive pricing that is based on each customer's individual needs and circumstances. It offers discounts to customers who have multiple policies or use online services, and financial advantages to customers who choose to invest their premiums in funds linked to mutual funds or receive a lump sum payment at the end of their policy term.

Final Thougs

We have found that each of these companies offers something unique and valuable to customers, depending on their needs, preferences and budget. Whether they are looking for low prices, flexible coverage, online service or global expertise, there is a company that fits the bill. However, we have also identified some areas where these companies can improve, such as innovation, customer feedback and regulatory compliance.

We hope this article has helped you learn about the best insurance companies in Germany and make an informed decision that suits your needs, bearing in mind that the insurance market is dynamic and competitive, and it is important to keep up to date with the latest trends and developments.

The responses below are not provided, commissioned, reviewed, approved, or otherwise endorsed by any financial entity or advertiser. It is not the advertiser’s responsibility to ensure all posts and/or questions are answered.

![Allstate Insurance [2025 Review]](/assets/images/c5cb2362877f284c0d4bbee9b16738a3.png)